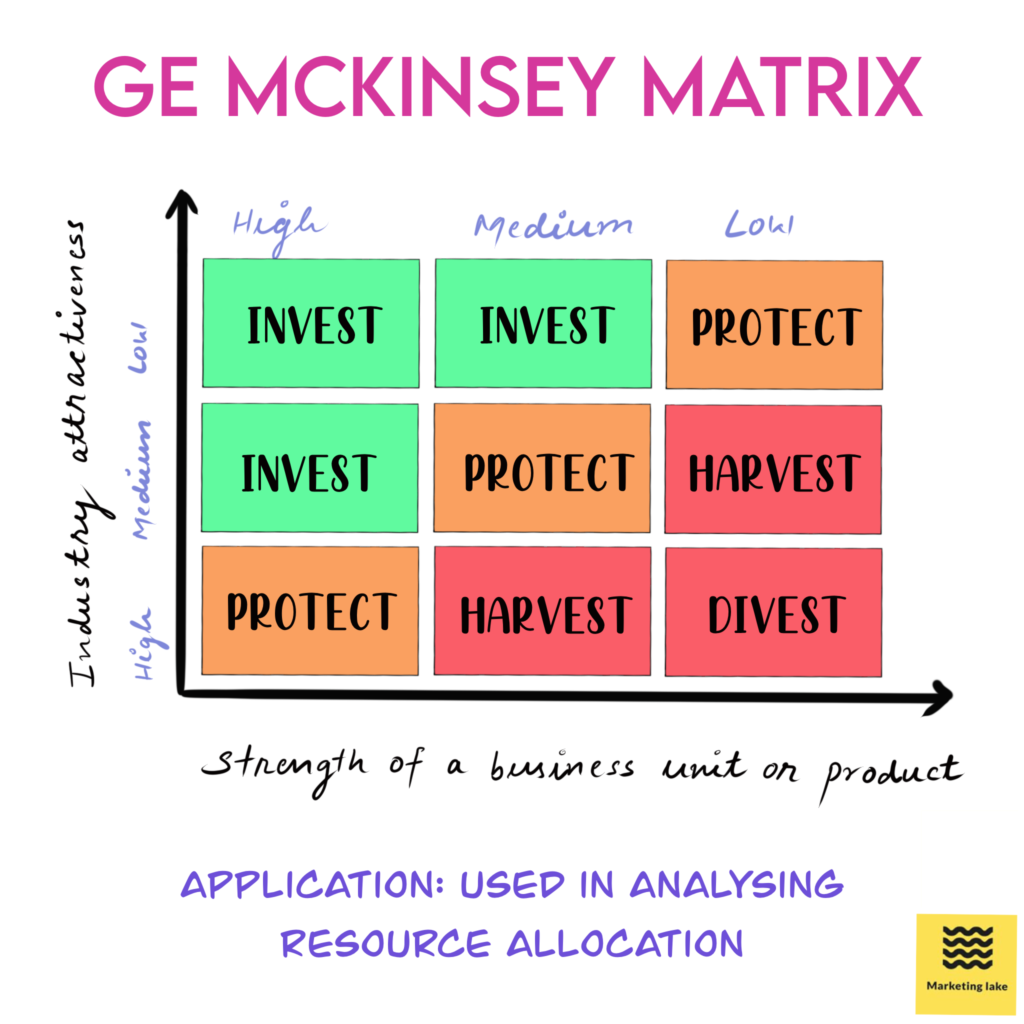

The GE McKinsey Matrix, also known as the McKinsey Nine Box Matrix: is a strategic tool used for business portfolio analysis that provides a structured way to evaluate business units on the attractiveness of the market involved and the strength of the firm’s position in that market.

The GE matrix was developed in the 1970s by McKinsey and Company consultancy group.

Many people ask the question: “GE matrix consists of how many cells?”

Well, as you know it is known as Mckinsey Nine Box Matrix as it has a nine-cell grid that measures business unit strength against industry attractiveness.

The GE McKinsey Matrix comprises two axes.

The Y-axis represents the attractiveness of the market, whereas the x-axis represents the competitiveness and competence of the business unit.

Both the axes get classified into three categories (High, Medium, Low), consequently creating nine cells.

You can learn more about the nine cells by clicking on this link.

Factors Affecting Market Attractiveness:

- Size of the market

- Market growth rate

- Market profitability

- Level of competition

- Demand Variability

- Market segmentation

- Industry structure

Factors Affecting Competitive Strength:

- Total market share

- Production capacity

- Relative brand strength

- Management strength

- Cost structure compared to competitors

- Level of product differentiation

- Production flexibility

Why do businesses use GE McKinsey Matrix?

The scarcity of resources is a big problem in the business world. With limited resources but many opportunities for using them, businesses got to choose a way to use their cash best.

It makes it very hard for a business to decide on which products the company should invest in but, after the development of GE McKinsey Matrix, it is no longer a headache.

GE McKinsey Matrix strategies:

The GE McKinsey matrix consists of three main strategies.

- Grow: In this category, the business units have high market attractiveness and high business unit strength. Therefore, corporates prefer to invest in these business units to generate high returns in the long run.

- Hold/Selectivity: In this category, the position of business units fall, and their future growth is unclear. Therefore, you hold the business as it is. It happens because there is a high competition that makes it hard for the business to catch up. Thus, in this case, you wait and see whether the business gains importance in the market or not.

- Harvest/Divest: In this category, the business unit becomes unattractive and weak. Therefore, you sell or liquidate the business.

How to use the tool:

- Determine the industry attractiveness of each business unit

It includes the following steps:

- List down factors

- Allocate weights

- Provide a rating to the factors

- Determine the final score

- Determine the competitive strength of each business unit

Step 2 is the same as Step 1. Only this time, the competitive strength of a business unit is evaluated.

- Factors list

- Weight allocation

- Factors rating

- Total score calculation

- Plot the information on the GE McKinsey Matrix

The next step is to position the score of industry attractiveness and competitive strength on the matrix. A circle should represent each business unit, and it should indicate the market size of each business unit as compared to other business units.

- Analyze the information

The next step is to analyze the information. An organization can adopt three investment strategies for each business unit.

They are:

- Grow or Invest areas

- Income or Selectivity areas

- Harvest or Divest areas

- Projection of the future potential of each business unit

After the analysis of the matrix, a company can see the current industry attractiveness and competitive strength of each business unit but doesn’t predict the future potential.

To have a projection of the future, the company should consult with industry analysts to determine whether the industry attractiveness will grow, stay the same, or decrease in the future.

- Prioritize investments

The last step is to decide where to invest the companies money.

GE McKinsey Matrix makes this step easier by evaluating the business units and identifying the best ones to invest.

A practical example of GE McKinsey Matrix

Divest or Harvest Strategy by Microsoft in Zune mp3 player-

In 2006, Microsoft launched its mp3 player named Zune. It gained a lot of attention, and Microsoft made a lot of profit through it. But a year later, Apple launched the iPhone, and mp3 players started escaping from the market. It resulted in a massive decline in the demand for mp3 players like Zune.

To get rid of the loss caused by this, Microsoft discontinued its mp3 player brand Zune in 2008.

Conclusion

Many businesses have various strategic business units (SBUs), all competing for investment. Therefore it makes it very hard for an organization to decide where to invest its limited resources.

The GE Mckinsey Matrix model is useful for analyzing your business units against multiple factors and provides a structured means to helps organizations understand where to make investments.

The model helps in determining the current situation of the business, as well as future positions of the business.

Thus this information is used as an input for making investment decisions.

You can also check our article on Millennial Marketing by clicking on this link.

. . .

Ayush Verma

Ayush Verma is currently a digital marketing intern at Marketing Lake and pursuing his undergraduate degree from Dr D Y Patil Global Business School And Research Centre, Pune. He is highly motivated to improve his skills and grow professionally.